Payroll tax calculator 2023

It will be updated with 2023 tax year data as soon the data is available from the IRS. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

1

Plug in the amount of money youd like to take home.

. The marginal tax rate is the rate of tax that employees incur on. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

Nanuet is located within Rockland County New. 2022 Federal income tax withholding calculation. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Employee portion calculators can be found under Resources on this page.

Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee. Subtract 12900 for Married otherwise.

See how your refund take-home pay or tax due are affected by withholding amount. The annual threshold is adjusted if you are not an employer for a. See your tax refund estimate.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use this tool to. Some states follow the federal tax.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Print a record of federal state and local tax settings filing status number of allowances check information pay period check number check date check amount. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Well calculate the difference on what you owe and what youve paid.

Get Started With ADP Payroll. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. How It Works.

Free Unbiased Reviews Top Picks. Cooper Arias LLP Accounting Accountability 892 State Route 17B PO Box 190 Mongaup Valley NY 12762 Phone. All Services Backed by Tax Guarantee.

As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. The maximum an employee will pay in 2022 is 911400. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

Ad Payroll So Easy You Can Set It Up Run It Yourself. The average cumulative sales tax rate in Nanuet New York is 838. Ad Compare This Years Top 5 Free Payroll Software.

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks. Thats where our paycheck calculator comes in.

This includes the rates on the state county city and special levels. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Sage Income Tax Calculator.

The state tax year is also 12 months but it differs from state to state. The tax is collected by the New York State Department of Taxation and. Calculate how tax changes will affect your pocket.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an. On the other hand if you make more than 200000 annually you will pay. Prepare and e-File your.

As earnings rise each dollar of earnings above the previous level is taxed at a higher rate. The payroll tax rate reverted to 545 on 1 July 2022. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Estimate your federal income tax withholding. Its so easy to. Get Started With ADP Payroll.

The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333.

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

1

1

![]()

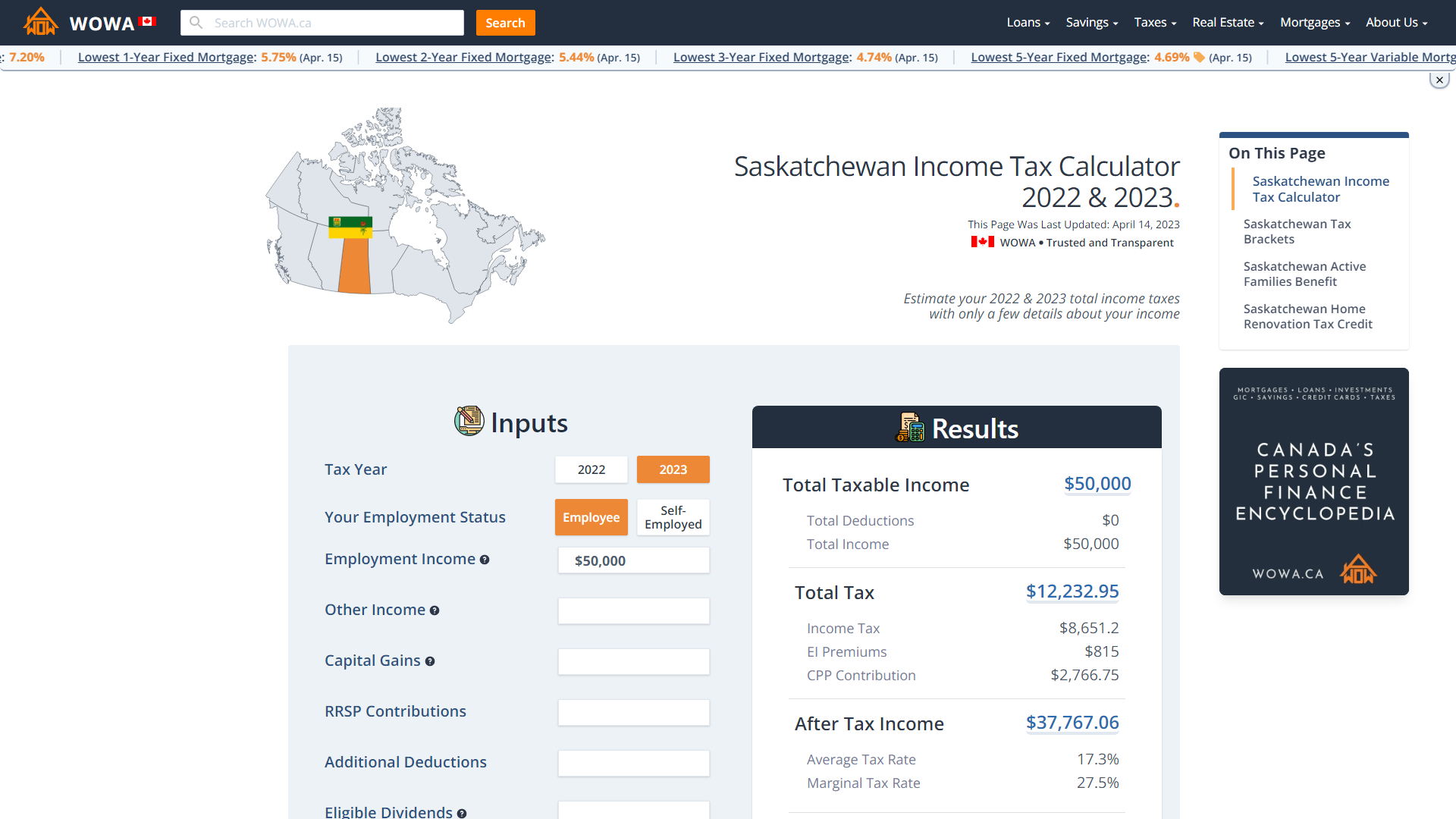

Canada Income Tax Calculator Your After Tax Salary In 2022

1

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

Dependents Credits Deductions Calculator Who Can I Claim As A Dependent Turbotax

Sharing My Tax Calculator For Ph R Phinvest

Dktf6dy6xg84lm

Us Salary Tax Calculator By Andrew Stacy Android Apps Appagg

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube